Public company conference calls are held quarterly, usually 10–15 days after the quarter end, and in a format which starts with management presenting the quarters’ results, followed by a series of analyst questions and management answers.

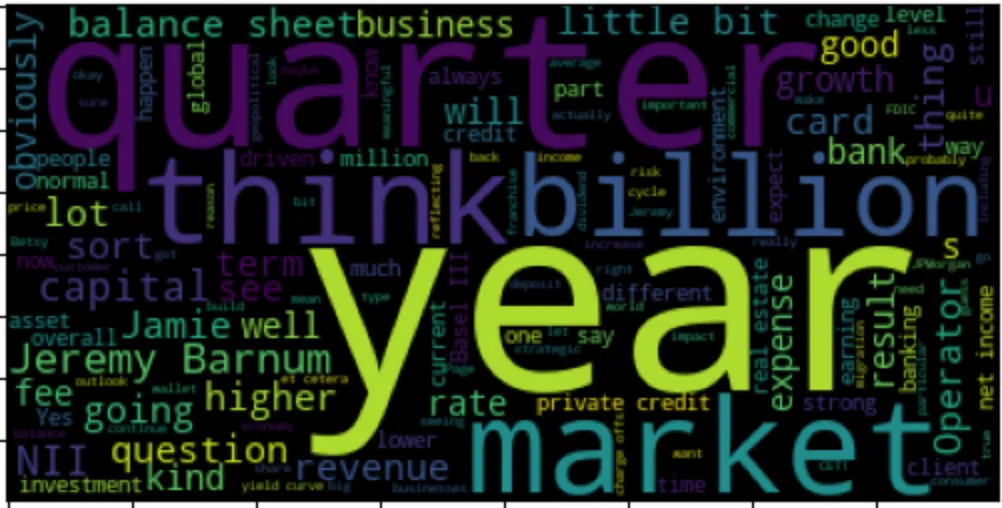

In this example we look at JP Morgan’s most recent Q1 2024 conference call from April 12, 2024. A quick word cloud, filtered by noun phrase, shows the key topics discussed on the call.

On the lower left we can see, in purple, “NII” which means “net interest income,” the amount a bank earns on its assets less the cost of deposits and equity funding.

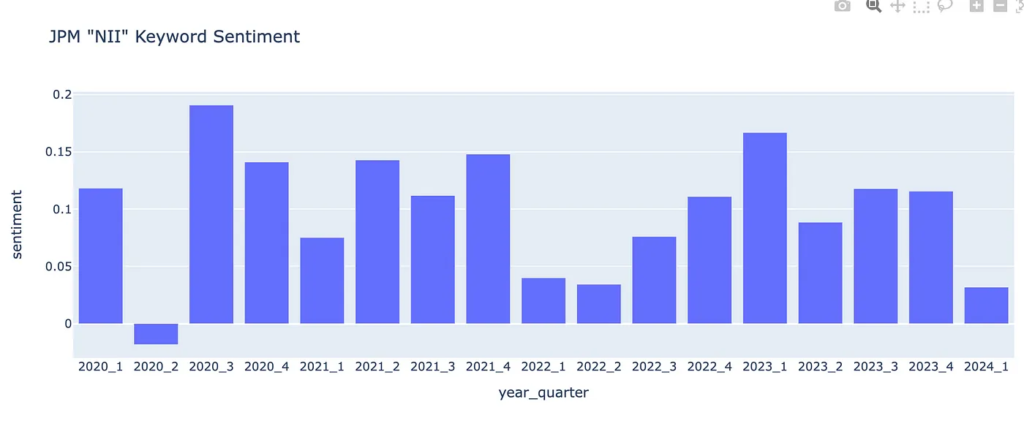

Drilling in to just “NII” in our transcript dataset, we can generate the sentiment around that keyword, shown in the chart below.

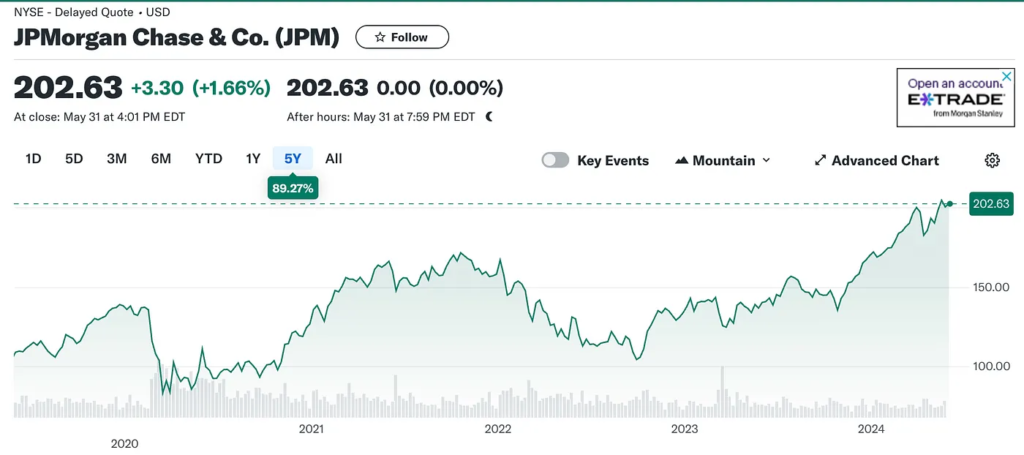

This important income statement line item tracks the stock performance reasonably well, with the exception of the current quarter.

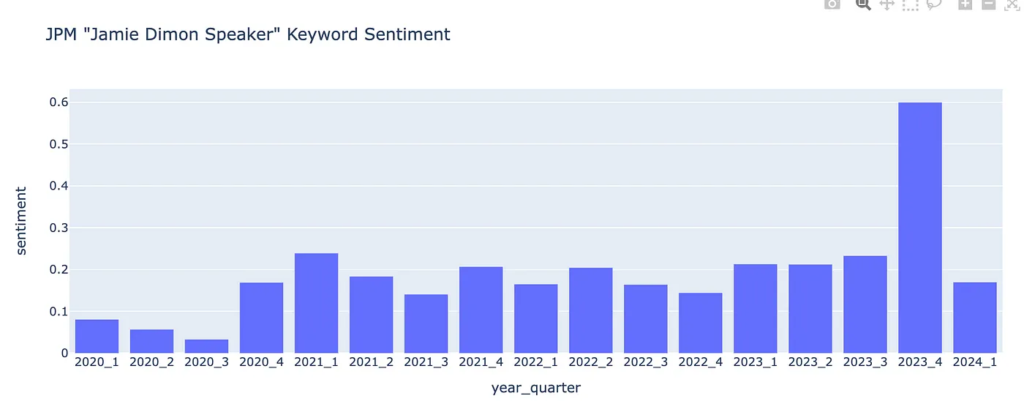

We can also look at sentiment aggregated for individual speakers. In this case, we can look at the CEO speaker Jamie Dimon’s statement sentiment from company calls. Interestingly, much like the NII sentiment, Dimon’s sentiment dropped off on the most recent call.

Which begs the question: is the stock shrugging off an indicator which has worked in the past, or is there some aspect of the data in 1q which we need to dig into further? My guess is there’s further work to do normalizing the sentiment data for q1 2024.

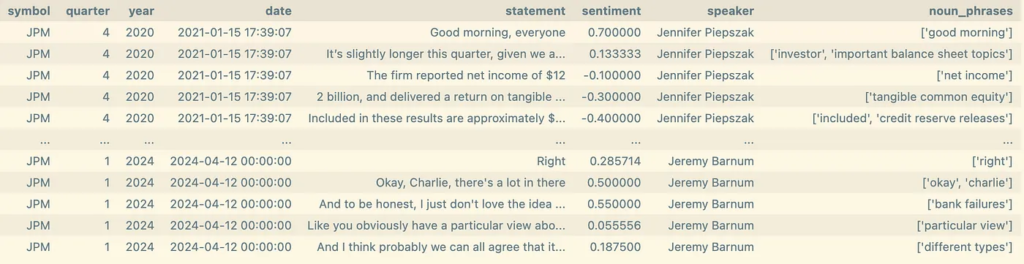

The format of the base processed data looks like this: